reverse sales tax calculator nj

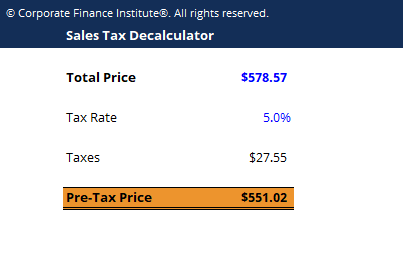

Divide the final amount by the value above to find the original amount before the tax was added. Why A Reverse Sales Tax Calculator is Useful.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

1050 cents per gallon of regular gasoline 1350 cents per gallon of diesel.

. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

See the article. The most populous location in New Jersey is Newark. The most populous county in New Jersey is Bergen County.

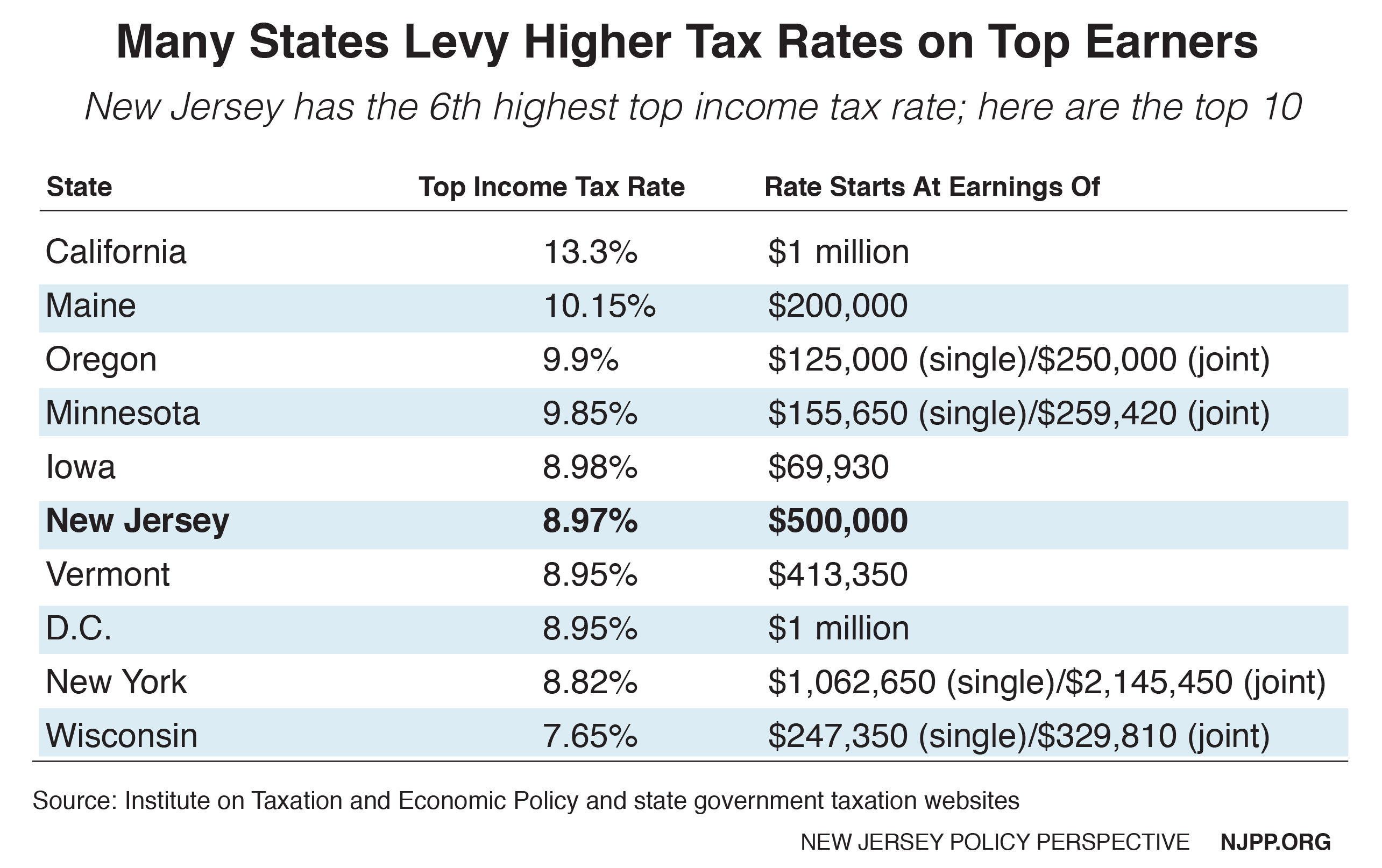

New Jersey has a single statewide sales tax rate. Sales and Gross Receipts Taxes in New Jersey amounts to 163 billion. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. The final price including tax 475 3563 51063. Interactive Tax Map Unlimited Use.

Amount without sales tax GST rate GST amount. Ad FREE Tax Training 2022 - Tax Consultant Course - Become Certified Tax Consultant - Try Now. New Jersey sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

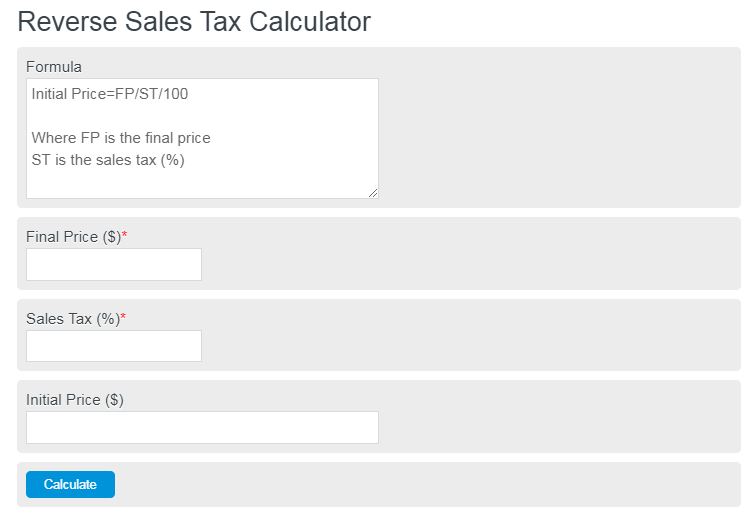

The Sales Tax Holiday takes place between August 27 through September 5 of 2022. You will need to input the following. Enter the final price or amount.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Jersey local counties cities and special. Average Local State Sales Tax. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Computers with a sales price less than 3000. You will pay 455 in tax on a 70 item. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

Divide tax percentage by 100 to get tax rate as a decimal. 242 average effective rate. 1 2018 that rate decreased from 6875 to 6625.

Amount without sales tax QST rate QST amount. Retail sales of the following are exempt during the Sales Tax Holiday. The sales tax rate does not vary based on county.

Tax 3563 tax value rouded to 2 decimals Add tax to the before tax price to get the final price. Divide tax percentage by 100. New Jersey Sales Tax Calculator Reverse Sales Dremployee Avalara Tax Changes 2022 Read This Now Thank Us Later Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel Cryptocurrency Taxes What To Know For 2021 Money.

Divide the tax rate by 100. A tax of 75 percent was added to the product to make it equal to 5246. Now find the tax value by multiplying tax rate by the before tax price.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Taxes in New Jersey. Why A Reverse Sales Tax Calculator is Useful.

In other words if the sales tax rate is 6 divide the sales taxable receipts by 106. The average cumulative sales tax rate in the state of New Jersey is 663. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you.

This is the after-tax amount. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law. Price before Tax Total Price with Tax - Sales Tax.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. Sellers should not charge Sales Tax on eligible items when purchased during the Sales Tax Holiday. So divide 75 by 100 to get 0075.

5246 1075 488. Multiply price by decimal tax rate. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Choose which one you are using in the drop. Find your New Jersey combined state and local tax rate.

65 100 0065. Ad Lookup Sales Tax Rates For Free. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Add one to the percentage. Sales tax amount or rate. New Jersey State Tax Quick Facts.

Tax 475 0075. Tax rate for all canadian remain the same as in 2017. Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850.

Reverse Sales Tax Calculations. Best Tax Consulting Training Updated - Become Certified Tax Consultant 100. Current HST GST and PST rates table of 2022.

The base state sales tax rate in New Jersey is 6625. Sales and Use Tax. List price is 90 and tax percentage is 65.

Tax rate for all canadian remain the same as in 2017. This takes into account the rates on the state level county level city level and special level. It is 429 of the total taxes 379 billion raised in New Jersey.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. 1 0075 1075. The price of the coffee maker is 70 and your state sales tax is 65.

Sales Tax Rate Sales Tax Percent 100. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. The Garden State has a lot of things going for it but low taxes are not among its virtues.

Here is how the total is calculated before sales tax. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663. 70 0065 455.

New Jersey has a 6625 statewide sales tax rate but also has 308 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0003 on top of the state tax. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

Us Sales Tax Calculator Reverse Sales Dremployee

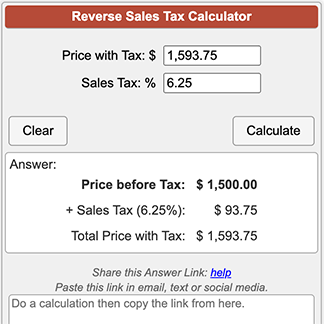

Reverse Sales Tax Calculator 100 Free Calculators Io

New Jersey Sales Tax Calculator Reverse Sales Dremployee

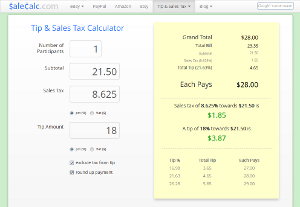

Tip Sales Tax Calculator Salecalc Com

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator De Calculator Accounting Portal

Reverse Sales Tax Calculator Calculator Academy

Report Archives Page 8 Of 11 New Jersey Policy Perspective

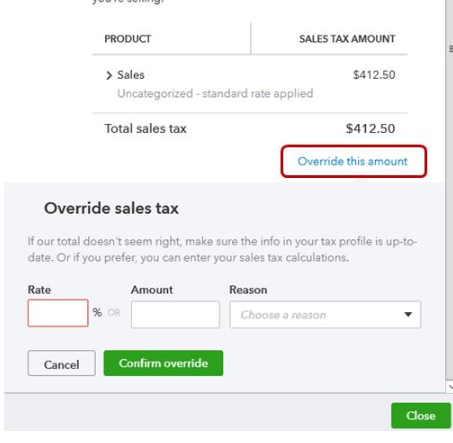

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Calculate Sales Tax On Car Outlet 60 Off Www Ingeniovirtual Com

Reverse Sales Tax Calculator Calculator Academy

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price